By partnering with AARP, UnitedHealthcare offers some of the simplest and most comprehensive Medicare supplemental insurance plans. Not only will you receive coverage from two trusted organizations, but you’ll also have access to the nation’s largest network of providers, making it more likely that you’ll be able to keep your current doctors and providers.

Here, I’ll go over UnitedHealthcare’s available plans, their costs, and how they compare to competitors. You’ll see why I think UnitedHealthcare is one of the best Medicare supplemental insurance providers.

Pro Tip: Not sure if you qualify for Medigap? Read my Medigap guide to learn about eligibility, enrollment periods, and types of policies.

UnitedHealthcare Pros

- Largest provider network

- Free house calls and virtual visits

- Premium pricing set for life

- Free online quotes and plan recommendations

UnitedHealthcare Cons

- Higher-than-average premiums

UnitedHealthcare Company Background

UnitedHealthcare is the largest health-insurance provider in the United States and one of the largest providers in the world. Founded in 1974, the company has a network of more than 1.3 million doctors and health-care workers, as well as 6,500 hospitals and care facilities all over the United States. If you’re looking for a company with a solid reputation and a large network, UnitedHealthcare fits the bill.

Which Medicare Supplement Plans Does UnitedHealthcare Offer?

UnitedHealthcare offers eight Medigap plans, each with its own pros and cons. Here is an overview of each.

| Plan A | Plan B | Plan C | Plan F | Plan G | Plan K | Plan L | Plan N | |

|---|---|---|---|---|---|---|---|---|

| Part A Coinsurance, extra year of hospital days after Medicare benefits run out | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Part A hospice/ respite care copay/ coinsurance | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% |

| Part A deductible | No | 100% | 100% | 100% | 100% | 50% | 75% | 100% |

| Part B copay or coinsurance | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% |

| Part B annual deductible | No | No | 100% | 100% | No | No | No | No |

| Part B excess charges | No | No | No | 100% | 100% | No | No | No |

| Skilled nursing facility care coinsurance | No | No | 100% | 100% | 100% | 50% | 75% | 100% |

| Foreign travel emergency | No | No | 80% | 80% | 80% | No | No | 80% |

| Blood (first 3 pints per year) | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% |

| Yearly out-of-pocket limit | No | No | No | No | No | $5,560 | $2,780 | No |

FYI: Older adults living in Wisconsin, Minnesota, and Massachusetts have different Medigap plans to choose from than the above chart.

- Plans A and B: These plans are good if you can afford more out-of-pocket expenses but want a lower monthly premium. Expect to pay more for Medicare Part B excess charges, emergency care when traveling internationally, and coinsurance for skilled nursing facilities.

- Plans C, F, and G: If you want more benefits and you’re OK paying a higher premium, you may want to consider Plans C, F, or G. They have the most supplemental coverage for out-of-pocket expenses Medicare approved but didn’t cover. You’ll pay more per month but less out of pocket.

- Plans K and L: If you want lower monthly premiums, Plans K and L are good options. Instead of paying the full coinsurance cost, however, the insurance covers only a percentage. Once your out-of-pocket limit is reached, all covered services will be completely paid for the rest of the year.

- Plan N: Plan N includes the coinsurance for Medicare Part B, but you will still have to pay copayments for visits to the emergency room or covered visits to a doctor. The monthly premium is middle of the road compared to the other plans.

UnitedHealthcare Extra Benefits

Since Medigap coverage is standardized by the federal government, it’s important to look into any extra benefits and perks offered by an insurer. Here’s what separates UnitedHealthcare from its competitors:

In-Home Visits

Through UnitedHealthcare’s HouseCalls program, you can receive yearly checkups — as well as other health screenings — right in your home. These visits cost no more than a regular doctor visit.

Over-the-Counter Discounts

Through FirstLine, UnitedHealthcare’s medication discount service, you can receive a monthly allowance for vitamins, supplements, and other over-the-counter medications.

The UnitedHealthcare App

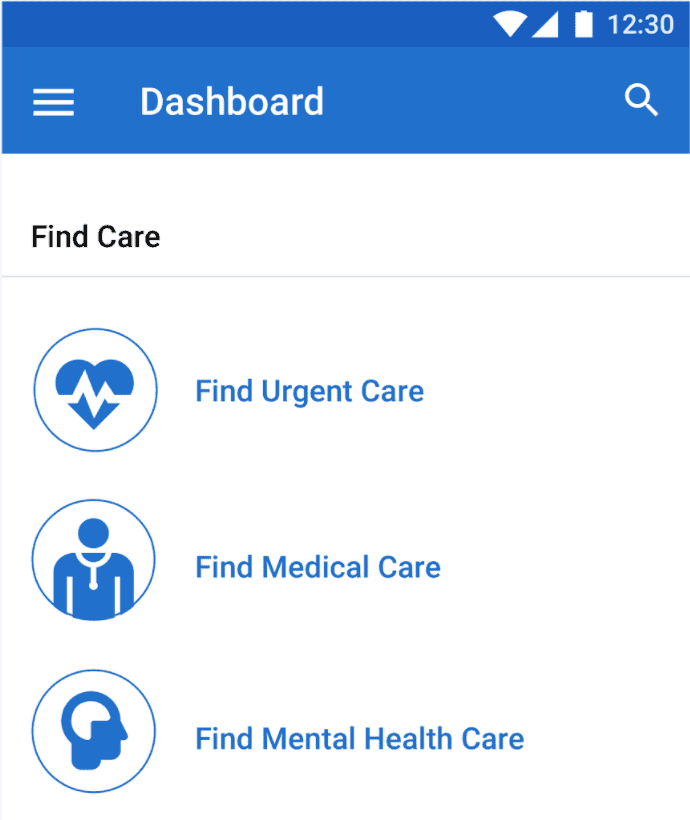

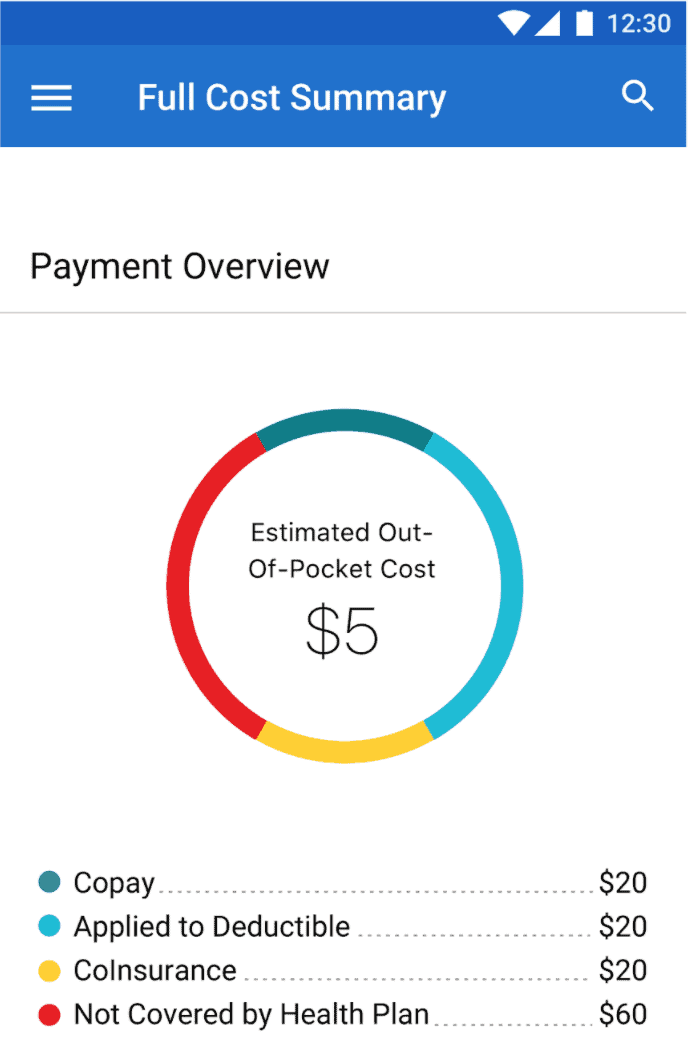

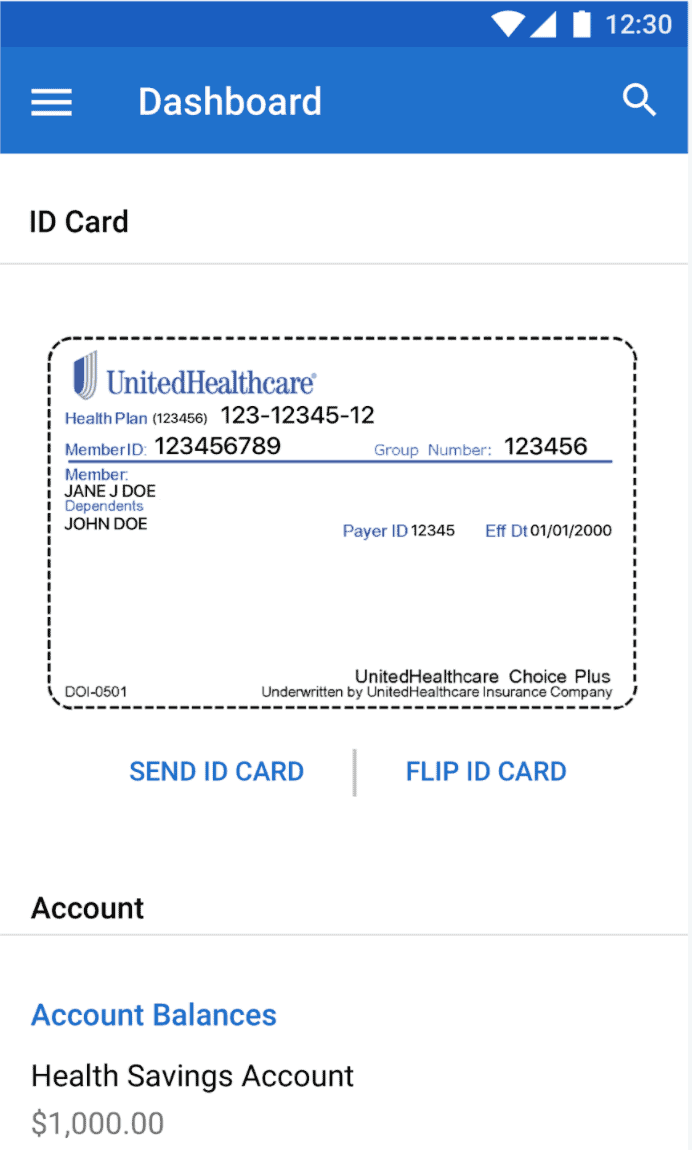

The UnitedHealthcare app, available for iOS and Android devices, allows you to access your health information on the go. I found it convenient to use the app to find medical, mental-health and urgent care, especially when I was out and about. I could also get a full summary of my payments, including copay, deductibles, coinsurance, and anything that wasn’t covered by UnitedHealthcare. When I left my insurance identification card at home before a routine checkup, I simply pulled out my phone and let the receptionist view my UnitedHealthcare app, which clearly displayed my ID.

How Much Do UnitedHealthcare Medigap Plans Cost?

The costs of any Medigap provider vary not only from state to state, but also from city to city and even person to person. Costs are higher in large cities such as New York and Los Angeles, while costs are lower in small towns and cities.

Here’s a sample of UnitedHealthcare plan costs in different cities for a nonsmoker over age 65:

UnitedHealthcare Medigap Plan Costs

| Plan A | Plan B | Plan C | Plan F | |

|---|---|---|---|---|

| Warrensburg, MO | $109.60 | $155.86 | $189.11 | $191.67 |

| New York, NY | $171.25 | $246 | $306.75 | $308.25 |

| Seattle, WA | $134.50 | $196.50 | $231.50 | $232.25 |

| Mobile, AL | $78.24 | $125.28 | $145.60 | $146.56 |

| Tempe, AZ | $93.12 | $137.12 | $155.52 | $156.80 |

How to Enroll in a UnitedHealthcare Medigap Plan

As a social worker, I’ve worked with older adults signing up for Medigap plans from UnitedHealthcare. It’s important to know that before you can apply for Medigap, you need to be enrolled in Medicare Parts A and B. If you sign up during the Medigap open-enrollment period, you are accepted automatically. The open-enrollment period lasts for six months, beginning when you turn 65 and you’re enrolled in Medicare Part D.

To view UnitedHealthcare’s plans, you can go to the company’s website and enter your personal information, including your ZIP code, birth date, and the dates your Medicare Parts A and B went into effect. The website will show you options, but you can also call an insurance agent to buy a plan.

Insurance is one of the few areas in which I actually appreciate brokers. When I spoke to UnitedHealthcare’s agents, they asked the right questions to see which plan was right, based on needs and lifestyle. Insurance policies and plans are so complicated that having extra assistance is almost always a good thing. If you want a personalized recommendation, call UnitedHealthcare’s agents, who are available on weekdays from 7 a.m. to 11 p.m. and Saturdays from 9 a.m. to 5 p.m. ET.

Alternatives to UnitedHealthcare Medigap

Don’t see a plan you like? I’ve reviewed other top Medigap insurance providers in addition to UnitedHealthcare, and these are some of my favorites:

- Cigna: Cigna serves more than 30 countries around the world. In the U.S., it offers Medigap plans A, F, G, and N. If you have other members of your household you’d like to cover, Cigna is a good option since it offers savings for each additional dependent.

- Aetna: Aetna offers plans A, B, F, G, and N, as well as high-deductible F. Plan F is the best option for superior coverage, since it covers copays for doctors’ offices and nursing visits. It will be phased out this year, though, so contact Aetna as soon as possible if you’re interested.

- Mutual of Omaha: Founded in 1909, Mutual of Omaha offers a wide variety of insurance, from health to banking and finance. It offers Medigap Plans A, F, high-deductible G, and N. The high-deductible G option kicks in after you reach your $2,000 out-of-pocket limit. I think of it as a strong safety net for people willing to pay that out-of-pocket cost.

- State Farm: State Farm originally offered only automobile insurance, but it now provides more than 80 million people with car, home, and health insurance. Its Medigap plans include A, C, D, F, G, and N. Plan C covers partial Plan B deductibles, which makes it a good choice if you want decent coverage without Plan F’s high premiums.

Bottom Line

I would recommend UnitedHealthcare as a Medigap provider. With nearly 50 years in business, it is a trustworthy health-insurance provider, and its eight Medigap plan choices provide options for older adults with a wide variety of lifestyles. Plus, I liked how easy it was to choose a plan using the company’s simple online quoting process.

To learn more about the best ways to augment your Medicare coverage, read our helpful guides:

UnitedHealthcare Frequently Asked Questions

-

Does UnitedHealthcare have a Medigap plan?

Yes, UnitedHealthcare offers eight Medigap plans: A, B, C, F, G, K, L, and N.

-

Is UnitedHealthcare a good Medicare supplement?

Yes. With eight Medigap plans to choose from, you can trust the largest health-care provider in the United States for your Medicare supplement plan.

-

Is it better to have Medicare Advantage or Medigap?

Comparing Medicare Advantage and Medigap is like comparing apples and oranges. Medicare Advantage and Medigap cover different areas, and they are not mutually exclusive. Medigap is meant to fill the gaps left by Medicare Advantage, which combines Medicare Plans A and B with prescription drug coverage. As long as you are enrolled in Medicare Parts A and B, whether through Original Medicare or Medicare Advantage, you are eligible for Medigap.

-

Does AARP offer Medigap insurance?

AARP offers Medigap Plans A, B, C, F, G, K, L, and N.

-

What are the best Medigap insurance companies?

The best Medigap insurance companies I have reviewed include UnitedHealthcare, Cigna, Aetna, State Farm, Mutual of Omaha, Colonial Penn, Blue Cross Blue Shield, Humana, and Anthem.