Is Medicare Advantage a Scam?

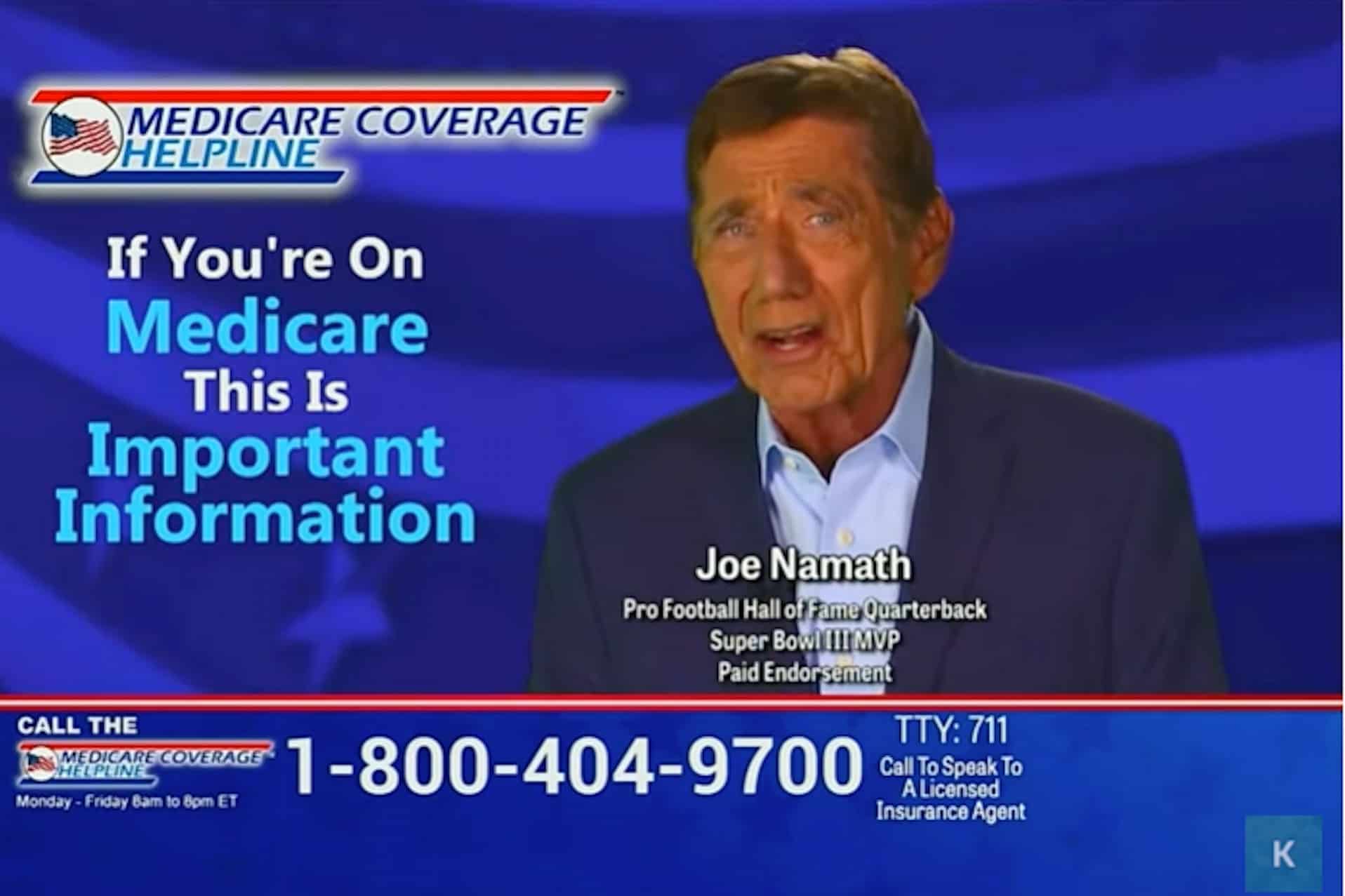

If you’ve ever turned on the television from Oct. 15 to Dec. 7, you’ve likely been bombarded with ads for Medicare insurance. During this time frame, known as the Medicare Open Enrollment Period, health insurance companies flock to convince Medicare beneficiaries to sign up for Medicare Advantage plans. They promise a number of compelling benefits, including Part B premium givebacks, $0 copays, and extra benefits for dental, vision, and hearing.

But, as with any aggressive marketing campaign, many people are left wondering: What’s the catch?

Proponents of Medicare Advantage plans claim that they’re a viable alternative to Original Medicare, one that offers additional coverage at more affordable prices. Critics, however, claim that Medicare Advantage is a giant scam from the insurance sector, one that rips off both beneficiaries and the taxpayers who –– through Medicare’s extensive federal funding –– end up footing the bill.

>> Related Reading: Medicare Helpline: Beware of Misleading Advertising

Medicare Advantage vs. Original Medicare

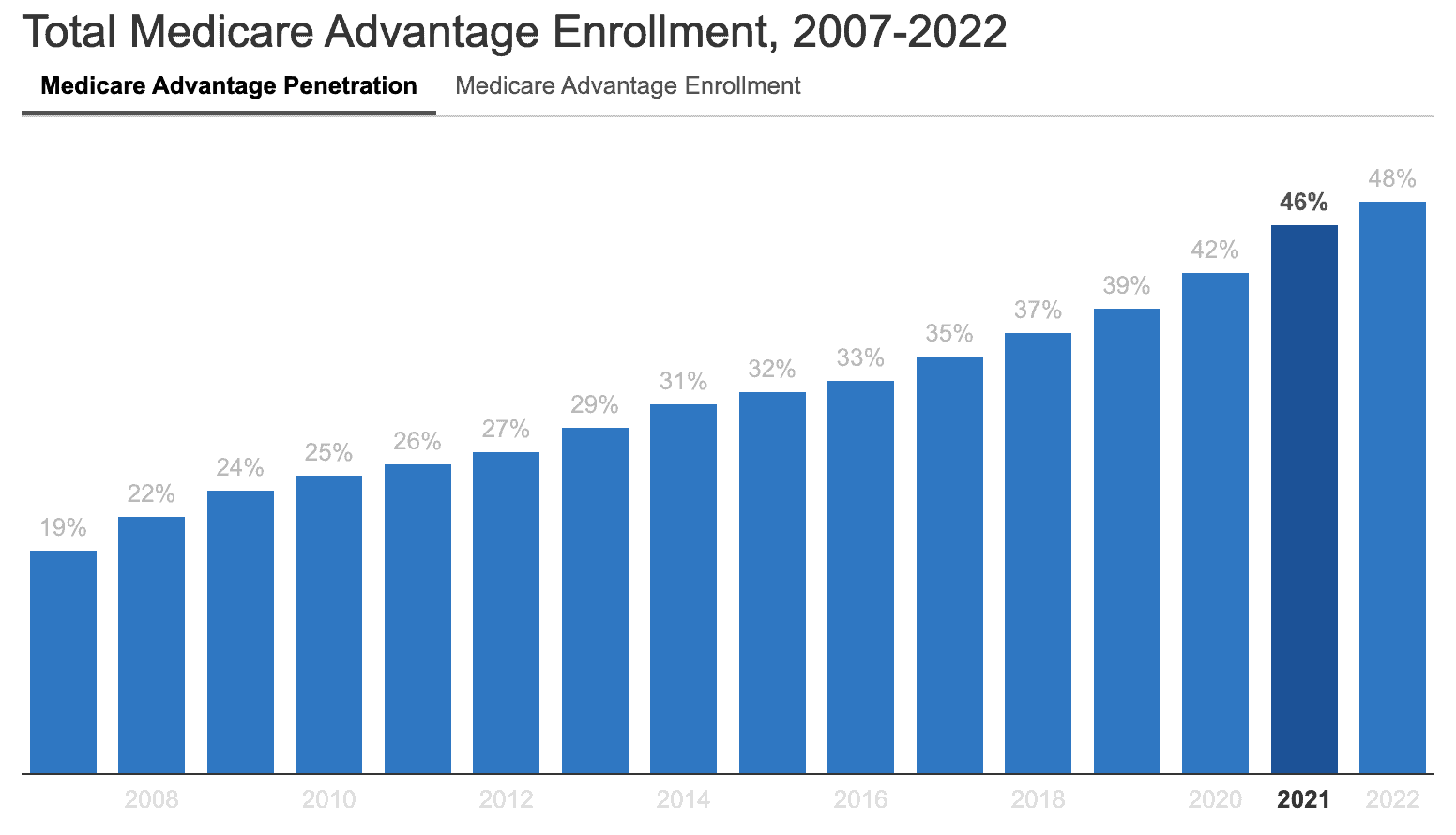

As of 2022, 28 million people are enrolled in Medicare Advantage plans, which amounts to nearly half of the 68.6 million people eligible for Medicare. However, Medicare Advantage is not the same as Medicare.

Medicare is a federal health insurance program for people 65 and older, as well as those with certain disabilities and conditions. Signed into law in 1965, Medicare’s primary goal was to provide health insurance to older Americans, a demographic often underserved by our employer-plan-driven insurance market. (As any 60-year-old can tell you, health insurance becomes prohibitively expensive the older you are.)

Medicare Advantage, however, is an alternative to Original Medicare offered by private insurers. Commonly referred to as Part C, Medicare Advantage plans are regulated by the Centers for Medicare & Medicaid Services (CMS). Under CMS Guidelines, these plans must offer the same coverage as Original Medicare. Many also offer additional benefits, including Part D prescription medication coverage which, with Original Medicare, must be purchased separately.

How Medicare Advantage Works

From the perspective of the beneficiary, Medicare Advantage works more or less like any other health insurance. Plans utilize a cost-sharing model similar to Original Medicare, wherein the insurer fronts most of the costs of treatment while the beneficiary pays a copayment (and potentially deductibles) after receiving treatments or services.

As a federal program, Original Medicare is funded primarily through payroll taxes and general revenue (interest gained from trust fund investments, as well as funds authorized by Congress). It’s also funded by premiums paid for by beneficiaries. Medicare Advantage, however, is funded partially by patient premiums but predominantly by the Medicare program itself. CMS pays Medicare Advantage providers a fixed monthly amount for each beneficiary’s expected healthcare costs.

Simply put, think of Medicare Advantage providers as contractors with CMS, taking on the responsibility of providing Medicare-equivalent insurance to people who would otherwise be insured by Original Medicare.

If, like this writer, you’re skeptical of the profit motives of publicly-traded insurance giants, then you can immediately see a conflict of interest. If insurance companies are paid a fixed monthly rate to insure each individual, then it would be in their best interest to deny as much coverage as possible. As we explore opinions on Medicare Advantage as a whole, you’ll notice that this conflict fuels many critiques of the program.

The Case for Medicare Advantage Plans

Proponents of Medicare Advantage plans tout two major benefits: lower out-of-pocket costs and extra benefits.

Lower Out-of-Pocket Costs

Although Original Medicare is an essential source of insurance to Americans, it’s not without its costs. Copays, coinsurance, and deductibles apply. Even if a beneficiary requires no medical care, they’ll still have to pay their monthly premiums for Part B ($164.90 in 2023) and, in some cases, Parts A and D.

With Medicare Advantage plans, these out-of-pocket costs are often reduced. As of 2022, a majority of Medicare Advantage plans (with Part D coverage, no less) have no monthly premiums. While Medicare Advantage plans still require you to pay your Part B premium, many plan carriers will pay some or all of your Part B premium costs in what’s known as a “Part B Giveback Benefit.”

Additionally, most Medicare Advantage plans have set copay amounts for physician visits and services, whereas Part B requires 20 percent coinsurance. Typically, this leads to lower out-of-pocket costs for outpatient services.

Medicare Advantage plans are also required to have an annual cap on out-of-pocket costs, known as a maximum out-of-pocket (MOOP). As of 2023, the MOOP for Medicare Advantage plans is $8,300, but many plans set lower limits. Original Medicare, however, doesn’t have a MOOP, meaning your copays and coinsurance could potentially exceed tens of thousands of dollars.

Extra Benefits

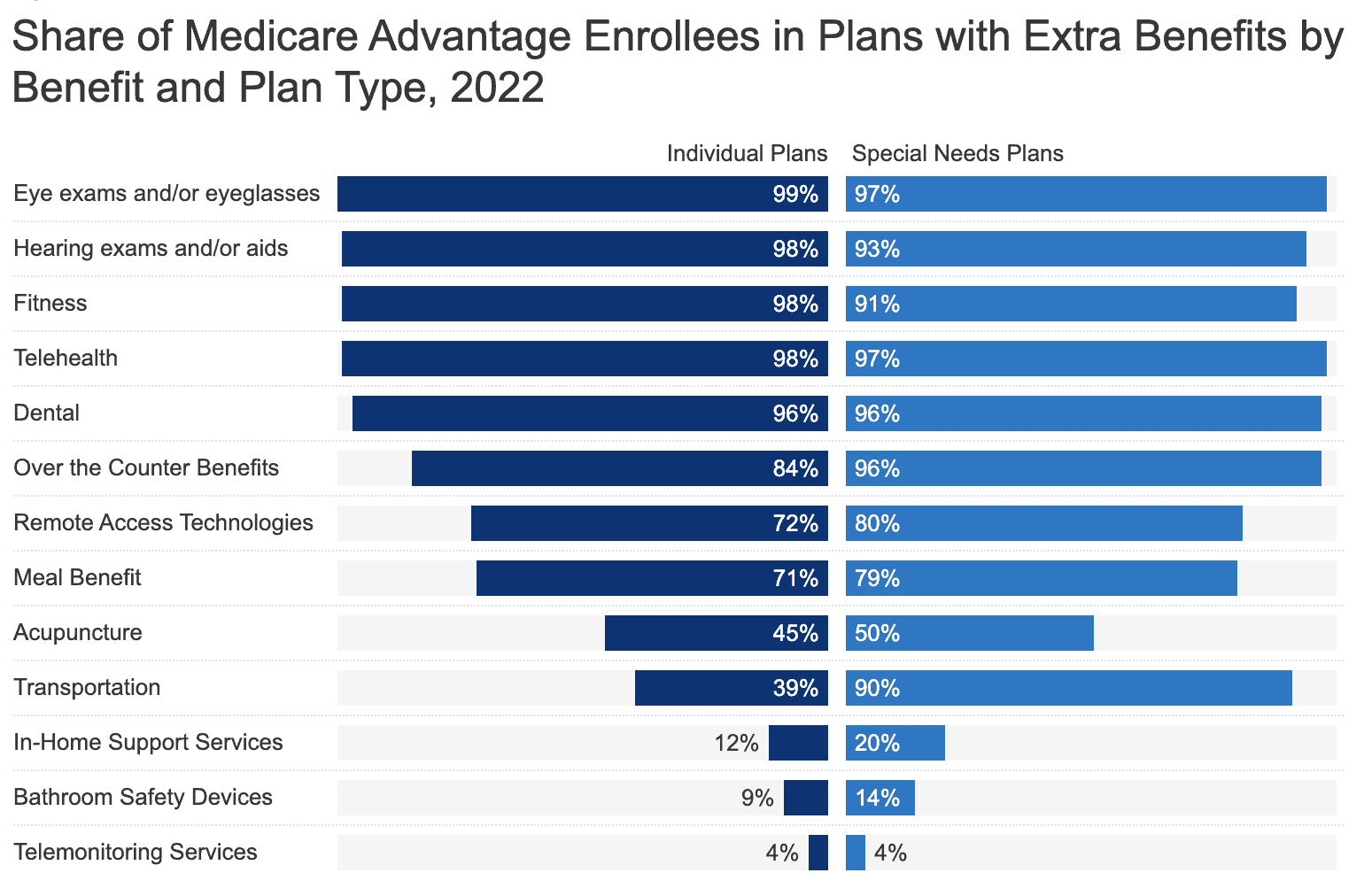

Original Medicare offers thorough coverage for “medically necessary” needs; however, these don’t include several commonly required services such as vision, dental, and hearing care. Many Medicare Advantage plans offer coverage for these services, as well as additional benefits like gym membership discounts, meal assistance, OTC medication allowances, and deals on medical alert devices, among others.

While the exact coverage and availability of these benefits will vary by carrier and plan, these types of add-ons are certainly a driving factor when choosing Medicare Advantage over Original Medicare. According to a survey by Medical Economics, 91% of people valued these benefits as part of their decision-making process.

Another added benefit of Medicare Advantage plans is that nearly 90% of them have built-in Part D prescription drug coverage. Of course, Original Medicare beneficiaries can purchase Part D coverage (and most do), but streamlining coverage in this manner can be effective.

The Case Against Medicare Advantage Plans

Although Medicare Advantage plans can provide benefits beyond those of Original Medicare, some argue that the program’s drawbacks –– network restrictions and claim denials –– outweigh the pros.

Network Restrictions

Similar to private health insurance, many Medicare Advantage plans have limited networks. As of 2015, over one-third of Medicare Advantage plans provided access to less than 30 percent of physicians in the country, and while network sizes vary by the specific plan and provider, they generally restrict provider access by a significant degree. Compare this to Original Medicare, which is accepted by over 90% of physicians and specialists nationwide.

Naturally, most patients only need access to a handful of medical professionals; however, issues arise when out-of-network care is needed. For example, if a beneficiary requires hospitalization while traveling out of state and the hospital isn’t within their plan’s network, then they may be on the hook for thousands of dollars.

Alternatively, if a beneficiary needs skilled nursing care or rehabilitation (which most adults will at some point), they’ll often find that their Medicare Advantage plan’s network is highly limited when it comes to inpatient facilities. In this scenario, a beneficiary will either have to delay necessary care or pony up the thousands of dollars per day it costs to receive out-of-network skilled nursing care.

Claim Denials

Denial of claims for medically necessary services is another rampant issue cited by Medicare Advantage critics. In 2021, Medicare Advantage insurers denied 6 percent of prior authorization requests, which amounts to roughly two million claims. Significantly, an investigation conducted by the U.S. Department of Health and Human Services found that 13 percent of these claims met the rules for receiving Medicare Coverage and would’ve been automatically approved under Original Medicare.

For those concerned that Medicare Advantage carriers might take funding from CMS and then deny coverage entitled to their beneficiaries, there’s ample evidence to support that this happens routinely.

A Burden for Taxpayers

With Medicare funding (and thus Medicare Advantage funding) coming predominantly from the taxpayer, this issue affects even those not yet eligible for Medicare benefits. From 2010-2019, Medicare Advantage plans cost the government over $106 billion, which amounts to around 3% more per person than Original Medicare during this time period. That said, looking at the same numbers, those enrolled in Medicare Advantage cumulatively received as much as 25% less healthcare spending. This raises the question: Where did all this money go?

One clue to this mystery is a study from 2019, which shows that Medicare Advantage companies spend 13.7% of their revenue on administration while Original Medicare only spends around 2%. One would think that Medicare dollars are better spent on, well, Medicare, as opposed to outsourcing to private insurance carriers.

This is why some members of Congress are lobbying for the Save Medicare Act — a bill that, if passed, would prohibit these private companies from using “Medicare” in the names of their insurance policies. The hope is to reduce the prevalence of overpaying for Medicare Advantage services which, in 2020 alone, cost taxpayers $12 billion.

With regard to this bill, Congressman Ro Khanna states: “It’s time to call out ‘Medicare Advantage’ for what it is: private insurance that profits by denying coverage, and the name is being used to trick seniors into enrolling… Our focus should be on strengthening and expanding real Medicare.”

At the time of writing, the bill is not in good standing in the House, with more than 80% confirming their support for Medicare Advantage as it stands.

An Imperfect Solution in an Imperfect System

As much as I’d love to definitively say that Medicare Advantage is a giant scam, in relation to Original Medicare, I’d say it’s still a viable option. Until Original Medicare expands to cover dental, vision, and hearing health (despite insurance lobbyists actively working to make sure this doesn’t happen), Medicare Advantage is a flawed alternative to a flawed system.

On one hand, Medicare Advantage can help cover additional services and save you money on coinsurance and monthly premiums. On the other hand, Original Medicare is accepted near-universally.

When enrolling in Medicare, you must consider both your immediate healthcare needs as well as those of the future. If a Medicare Advantage plan offers an extensive network of providers within your area, then it might be worthwhile, pending additional benefits.

Alternatively, if you’re wary of Medicare Advantage providers, Original Medicare is still a viable option, especially when paired with a Medigap policy that can cover your premiums, coinsurance, copays, and deductibles.

To learn more about the confusing yet essential world of Medicare, read our helpful guides: