An Audiologist's Guide to Hearing Aids

Hearing loss can cause social isolation and frustration. This, in turn, impacts many areas of life: work, relationships, and even something as simple as listening to the birds outside your window. As a trained audiologist, it is my job to help people reengage in these facets of life.

Most individuals with hearing loss have sensorineural hearing loss, which is caused by genetics, aging, and noise exposure. No medicine, surgery, or treatment can remedy this. Therefore, hearing aids are the best solution.

Although hearing aids do not restore your natural hearing, they provide many short- and long-term benefits. Untreated hearing loss is associated with higher rates of depression, anxiety, and social isolation. Hearing loss has also been associated with increased rates of dementia. Hearing aids can help to maintain social, emotional, and cognitive well-being by allowing people to hear and participate in life once more.

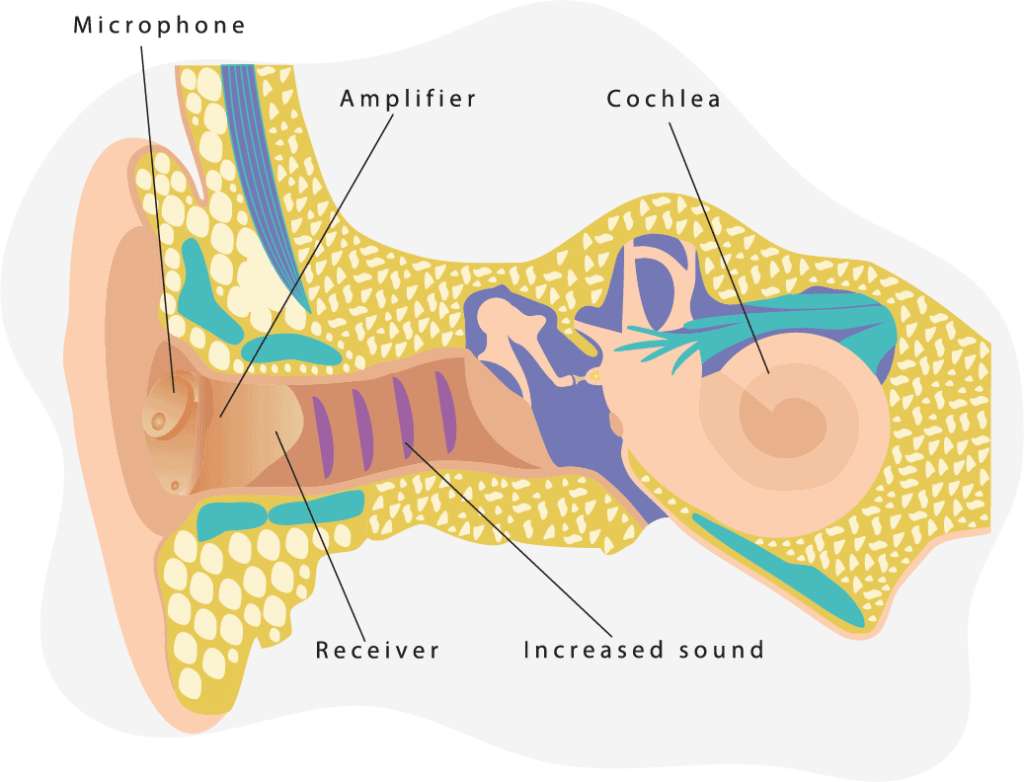

How Do Hearing Aids Work?

All hearing aids have three basic parts: Microphones that pick up the sounds around you, amplifiers that make the sounds louder, and receivers that relay the amplified sounds into your ear. While modern hearing aids may have additional features and parts, their basic function relies on these three parts.

Hearing Aid Features

Hearing aids are digital now, meaning they can be finely programmed to your specific variety of hearing loss. The hearing aid amplifies the environmental sound in the amount and manner to which it is programmed.

All hearing aids now have feedback suppression and some background noise reduction, digitally or through directional microphones. There are, however, some newer features that can vary between hearing aids — these really impact the quality of life. When I am selecting a new set of hearing aids with my patients, I always have a detailed conversation about their lifestyle. One patient may talk on the phone every day and find direct Bluetooth streaming to be their most important feature. However, others might have dexterity issues that make changing tiny batteries impossible. In the latter case, it may be essential that batteries are rechargeable.

Some features to consider:

- Rechargeable batteries: Some hearing aids now have lithium-ion batteries and even rechargeable cases, similar to AirPods. This can be really handy for frequent travelers and individuals with dexterity issues.

- Telecoil: Telecoils allow you to pick up the sound from loop systems, which are commonly installed in large venues. If you frequent locales with loop systems, ensure the hearing aids you purchase have a telecoil. Although this is a simple, long-standing technology, not all hearing aids include one (usually to save space).

- Wireless connectivity: Most hearing aids now have wireless connectivity that will allow them to connect to a remote control or streamer. Some even have Bluetooth, which allows direct connectivity with audio streaming to cell phones or tablets. If you are interested in direct audio streaming, it’s a good idea to confirm that your hearing aids will be Bluetooth-compatible with your particular phone model. Not all hearing aids are compatible with all cell phones, even if they have Bluetooth.

Fun Fact: The first hearing aid with Bluetooth compatibility was introduced by ReSound in 2014.

The Best Hearing Aids of 2025

After hours of research and testing, we’ve come up with our list of this year’s best hearing aids. We’ve also compiled lists of the best hearing aids for certain needs and budgets.

- Best Affordable Hearing Aids November 25, 2025

- Best Over-the-Counter Hearing Aids December 17, 2025

- Best Rechargeable Hearing Aids March 6, 2025

- Best Tinnitus-Therapy Hearing Aids November 26, 2025

- Best Behind-the-Ear Hearing Aids March 6, 2025

- Best iPhone Hearing Aids November 26, 2025

- Best Android Hearing Aids November 26, 2025

Where to Buy Hearing Aids

There are a variety of locations where hearing aids can be purchased. However, the most common places are private audiology practices or hearing aid dispensing chains. Having worked in both settings, I can safely say they can each provide quality hearing solutions.

Private audiology practices can be independent or connected to an ENT practice. Dispensing chains, however, are usually owned by hearing aid companies. Or, they are part of other stores, like the hearing centers inside Sam’s Club and Costco.

If you have complex hearing needs — such as recurrent ear infections or sudden, unexplained hearing loss — it’s probably best to go to an audiologist. Otherwise, consider the quality of care, cost, location, and rapport with the provider when choosing.

Remember that audiologists often work for a hearing aid dispensing chain (I know many that do), and both can provide excellent quality care. Like any profession, the quality of care will vary from individual to individual. Something to consider, though, is that the primary goal of a hearing aid dispensing chain is always to sell hearing aids — whether or not this addresses your issues.

Audiologists vs. Hearing Aid Dispensers

| Audiologist | Hearing Aid Dispenser | |

|---|---|---|

| Education Requirements | Graduate Degree + Licensure Exam | High School Diploma + Licensure Exam |

| Will serve | All ages | Adults only |

| Can Perform |

|

|

Buying Hearing Aids Online

Although it is possible to purchase some hearing aids online with a virtual hearing test, it’s best to get an initial hearing evaluation in person. Whether through a dispenser or audiologist, an in-person hearing evaluation will have properly calibrated headphones and an in-depth physical exam of your ears. Sometimes, hearing issues are simply caused by obstructions such as wax buildup — an issue that won’t be resolved through hearing aids.

After an in-person hearing test in a properly soundproof environment, you’ll obtain written results. If you wish to purchase hearing aids online, you can refer to those results while browsing through reputable providers. They will conduct a remote fitting of the hearing aids by a licensed professional.

Beware of buying second-hand hearing aids or those you’d find on eBay. Remember, hearing aids must be programmed. Even if you find a really good deal on a hearing aid, you will need to pay someone to program it to address your hearing loss. Additionally, these aids are not likely to be covered under warranties.

Hands-On Hearing Aid Reviews

At TheSeniorList, we strive to provide the most accurate information possible through thorough research and testing. Here’s a selection of our hands-on hearing aid reviews.

- Eargo Hearing Aids Review December 8, 2025

- MDHearing Aid Review November 26, 2025

- Lively Hearing Aids Review December 18, 2025

How to Choose a Hearing Aid

Often, patients come into my office with a specific preference regarding their hearing aid style. However, style is more than a matter of appearance. Different hearing aid styles suit different levels and types of hearing loss; this means I can only recommend a particular kind after assessing a patient’s hearing and lifestyle needs.

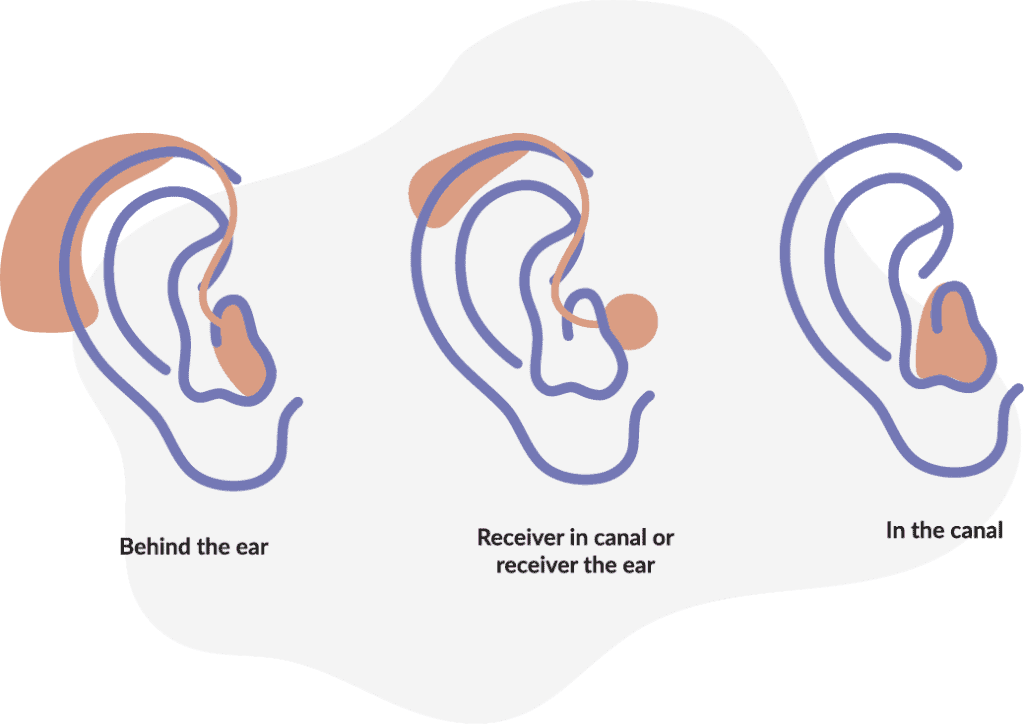

There are three main styles of hearing aids: BTE, RIC, and custom.

- BTE (behind-the-ear) hearing aids sit behind the ear and have a tube that runs down to a mold in the ear. This style is most often used for severe or profound hearing losses.

- RIC (receiver in the canal) hearing aids also have a piece that sits behind the ear, but it’s typically smaller than that of BTE aids. Rather than a tube, RIC aids have a small, almost invisible wire running down to a small flexible tip called a dome (like an earbud) that fits completely in the ear canal. This style is suitable for all types of hearing loss, and it’s especially good for mild cases. RIC aids can be fit “open,” which still allows natural sound in and out of the ear canal.

- Custom hearing aids are made based on an impression of your ear canal. As the name implies, the fit will be specific to the individual. These aids can be tiny, fitting completely inside the canal. Or, they can be larger, filling up the outer portion of the ear — the concha.

The biggest factors in choosing a style of hearing aid are the level and type of hearing loss. Similar to those who are visually impaired, when you have a hearing loss, your hearing health-care provider will program your hearing aids to your prescription. Not all prescriptions work with all hearing aids. In fact, you can have too little hearing loss for an “invisible” or a complete in-the-canal hearing aid! If you don’t have any low-frequency hearing loss (think the bass end of a piano), you might not be a good candidate for invisible hearing aids.

One feature of invisible hearing aids is that they will completely block out the good hearing you have. This is OK if you have a lot of hearing loss across low and high frequencies, as the hearing aids will amplify them anyway. However, one very common configuration of hearing loss is that you’ll experience good hearing in the low frequencies and poor hearing in the high frequencies. In this case, you will get the best fit to your prescription with an “open fit”; this means letting in all the natural low frequencies, giving you a natural sound quality.

If you try to wear an invisible hearing aid anyway, you will get the “occlusion effect.” This means hearing your own voice booming in your head — and even hearing yourself chewing. On the other hand, if you have severe hearing loss, it might be impossible to make a hearing aid completely invisible and still powerful enough to meet your prescription. You can likely still get a custom in-the-ear hearing aid. However, it just might not be completely invisible.

Other than your hearing loss, the other good things to consider when purchasing a hearing aid are its features. Do you like to stream music or audiobooks from your phone? You might want Bluetooth connectivity. Are you worried about batteries going out in the middle of the day? You might want rechargeability. Make sure to discuss all the available options with your hearing health-care provider.

Hearing Aid Shopping Tips

When you are looking to buy hearing aids, it’s OK to shop around. Hearing aids typically last three to five years, and you will likely be in regular contact with your provider. It might just be for a check-up, a hearing aid cleaning, or a hearing retest if your hearing has changed. This is why it’s important that you are comfortable with and trust your provider.

When you purchase a hearing aid, how well it works for you partially depends on the skill of the person who programs it. One thing to ask before purchasing is if the provider uses “real ear” or “verification” measures. This is a simple process where a tiny tube microphone is put down in the ear canal while the hearing is worn; the amount of sound that reaches your eardrum is confirmed to be the amount of sound that your prescription dictates. Because everyone’s ear canal is shaped differently, this is the only way to ensure your hearing aids are accurately fitted.

Our Favorite Hearing Aid Brands

To help you get started with your search for the ideal pair of hearing aids, we’ve compiled detailed overviews of some of the most popular hearing aid providers.

- Beltone Hearing Aids and Pricing November 26, 2025

- Eargo Hearing Aids and Pricing December 2, 2025

- Hear.com Hearing Aids and Pricing November 26, 2025

- Lively Hearing Aids and Pricing December 18, 2025

- Jabra Enhance Hearing Aids and Pricing December 18, 2025

- MDHearingAid Hearing Aids and Pricing December 17, 2025

- Oticon Hearing Aids and Pricing May 9, 2025

- Phonak Hearing Aids and Pricing November 26, 2025

- ReSound Hearing Aids and Pricing November 26, 2025

- Rexton Hearing Aids and Pricing December 4, 2025

- Signia Hearing Aids and Pricing February 20, 2025

- Starkey Hearing Aids and Pricing February 20, 2025

- Widex Hearing Aids and Pricing November 26, 2025

The Best Hearing Aid Brands Compared

If you’re torn between two hearing aid providers, then check out one of our handy comparisons.

- Miracle-Ear vs Phonak Comparison November 26, 2025

- Phonak vs Beltone Comparison November 26, 2025

- Phonak vs Oticon Comparison November 26, 2025

- Phonak vs Starkey Comparison November 26, 2025

- Phonak vs Unitron Comparison November 26, 2025

- Phonak vs Widex Comparison November 26, 2025

- ReSound vs Oticon Comparison November 26, 2025

- ReSound vs Phonak Comparison November 26, 2025

- ReSound vs Signia Comparison November 25, 2025

- ReSound vs Starkey Comparison November 26, 2025

- Widex vs Oticon Comparison November 26, 2025

- Widex vs ReSound Comparison December 19, 2025

- Widex vs Signia Comparison November 26, 2025

- Widex vs Starkey Comparison January 21, 2025

- Jabra vs Eargo Comparison November 26, 2025

How Much Do Hearing Aids Cost?

The average cost of hearing aids in the U.S. is $1,000-$4,000 each. Remember though, most people have hearing loss in both ears, which means you’ll likely need two hearing aids — doubling the cost. A large percentage of this cost is due to the hundreds of millions of dollars that go into research and development every year. Every new generation of hearing aids is smaller, with more natural sound quality and more features.

This price range also reflects different technology levels, as well the amount of service and follow-up care that is included. Are they basic or high-end hearing aids? Does the price include all follow-up appointments for the life of the hearing aid? How long is the warranty? These are good questions to ask the provider. You should also inquire about financing options.

How Long Do Hearing Aids Last?

Hearing aids have tiny mechanical parts. Like anything mechanical, they wear out over time. A typical hearing aid warranty is two to four years. With my patients, I usually find that their devices last anywhere from three to five years. I find that the biggest factor is how well and regularly the hearing aids are cleaned and maintained.

Regularly cleaning your hearing aids — and drying them in a dehumidifier if you perspire a lot or live in a humid environment — can help them last longer and sound better. Your hearing health-care provider should teach you to clean and care for your hearing aids when you purchase them.

Does Medicare Cover Hearing Aids?

Medicare does not cover the costs of hearing aids or hearing exams for the purposes of fitting hearing aids. If you have a Medicare Advantage plan, it may cover some of the cost of a hearing aid.

Does Medicaid Pay for Hearing Aids?

Medicaid will cover the cost of a hearing test for a hearing-related health condition, like an ear infection. Medicaid always covers hearing aids for children. For adults, it varies from state to state. Some states provide coverage for one hearing aid, some for both, and some don’t provide any at all.

Does Insurance Cover Hearing Aids?

Only five states — Arkansas, Connecticut, Illinois, New Hampshire, and Rhode Island — require insurance policies to provide hearing aids for adults. Even in these states, coverage quality varies from plan to plan. A plan might cover $500 toward the cost of hearing aids, or it might cover them completely.

Even if your state doesn’t require hearing aid coverage, some plans in other states do provide hearing aid coverage or participation in a “third-party hearing aid benefit.” This benefit allows you to access certain discounts or specific pricing. However, you must use the specific providers and products contracted with the third party. In this model, the insurance company doesn’t usually pay anything; rather, the patient pays the third party directly. While this can save you money, it can also reduce the quality of care. Third-party hearing aid companies usually pay hearing health-care providers a fixed price to fit the hearing aids. Plus, they limit the amount of follow-up care the patient is entitled to in order to keep costs low.

Are Hearing Aids Durable Medical Equipment?

Hearing aids are medical equipment that is regulated by the FDA. But, they aren’t always considered Durable Medical Equipment (DME) for health insurance purposes. It’s best to check your specific policy.

Are Hearing Aids Tax Deductible?

Although hearing aids are often not DME for insurance purposes, hearing aids are deductible as a medical expense on federal income taxes. If you itemize your medical expenses, you can also deduct the cost of batteries, hearing aid repairs, and even the tests and visits needed to obtain them.

Can You Get Free Hearing Aids?

Veterans of military service often qualify for hearing aids through the Department of Veteran Affairs. Contact your local VA medical center to enroll in these services. All veterans who are eligible for VA medical care are eligible for hearing aids if their hearing loss warrants it. This is the case even if the hearing loss was not caused by military service. The VA only fits premium-level hearing aids, so this is a great benefit if you qualify.

There are also vocational rehabilitation programs that provide hearing aids, these vary from state to state. In addition, local civic organizations like the Kiwanis Club or Lions Club can help provide financial assistance. The Hearing Loss Association of America provides up-to-date information about programs that assist people with purchasing hearing aids and other assistive listening devices.

Conclusion

Embarking on the process to purchase hearing aids can seem overwhelming and lengthy. But, it’s worth it to be able to fully reengage in the conversations around you. It’s OK to thoroughly research your options — including insurance benefits and multiple providers and products — before making a final decision.

Hearing aids do not restore natural hearing, but they can allow you to once again hear conversations, music, and other essential sounds of life. It takes some people a while to get used to wearing hearing aids. Plus, you may require some adjustments after your initial fitting to get your desired sound quality. It’s a good idea to take someone close to you whose voice you are familiar with to your initial hearing aid appointments. You’ll get a better idea of how the hearing aids sound, and they can help provide support.