LifeLock for Seniors: Tested and Reviewed

According to SeniorLiving.org, roughly 1 in 10 seniors is a victim of identity theft in a given year. While there are a number of quick preventative methods to secure your personal information, a service like LifeLock can help you actively monitor threats and address them.

LifeLock identity theft protection covers a wide variety of areas, both online areas like the dark web, and offline areas like home titles and crime records. While in the past, LifeLock offered a plan for seniors specifically, as of 2025, that is no longer the case. That being said, the service can still benefit seniors, alerting them if someone has stolen their identity, helping them restore it, and helping them get back the money they lost. I bought LifeLock’s Ultimate Plus package to test it out and tell you just how easy (or not so easy) it is to use and whether it’s worth buying.

FYI: LifeLock may have performed well in our tests, but it’s far from the most affordable option. To find the best identity theft protection service for your budget, check out our rundown of this year’s best identity theft protection services for seniors.

Pros and Cons

Pros

- Up to $3 million in coverage: The Ultimate Plus package offers up to $3 million for lawyers and experts, plus the reimbursement of stolen funds and personal expenses.

- Social media and investment account monitoring: Again, the Ultimate Plus package monitors both social media and investment accounts for your personally identifiable information (PII).

- Identity restoration services: Either plan will help you gain control after you lose your identity, freezing your accounts and helping you get back any money you lost.

Cons

- No senior discount: LifeLock no longer offers any discounts for seniors, as of 2025.

- Prices increase after the first year: Prices increase pretty significantly after the first year, and they weren’t cheap to begin with.

LifeLock Plans Compared

LifeLock’s two plans both include coverage for lawyers, stolen fund reimbursements, and personal expense reimbursements. But while both plans offer up to $1 million in legal coverage, that number goes down to $25,000 with the Standard package for both stolen funds and personal expense reimbursement, while it stays at $1 million with the Ultimate Plus package. The Ultimate Plus package also includes credit monitoring from all three credit-reporting bureaus instead of one, plus, more areas monitored such as:

- 401(k) and investment accounts

- “Buy now, pay later” offers

- Crimes committed in your name

- Home titles

- Phone takeovers

- Social media

Both plans offer basic identity and Social Security number monitoring, however.

| Membership | Standard | Ultimate Plus |

|---|---|---|

| Cost | Monthly: $11.99

Annually: $89.99 |

Monthly: $34.99

Annually: $239.88 |

| Legal coverage | $1 million | $1 million |

| Stolen funds reimbursement | $25,000 | $1 million |

| Personal expense reimbursement | $25,000 | $1 million |

| Credit monitoring | 1 bureau | 3 bureaus |

| Identity and Social Security number monitoring | Yes | Yes |

| Social media monitoring | No | Yes |

| Phone takeover monitoring | No | Yes |

LifeLock Senior Plan

LifeLock used to have a specific plan for seniors. However, as of 2025, this plan no longer exists, so seniors will pay the same amount as everybody else. That being said, there is a discount for AARP members that lets them get identity theft protection for 44 percent off, or $6.99 a month. If you’re an AARP member, you can buy the plan either online or by calling Norton at 1-844-506-4199.

LifeLock Pricing

LifeLock offers two plans: Standard and Ultimate Plus. I chose to pay for a monthly membership, which for the Ultimate Plus plan, costs $34.99 a month. I could have saved 19 percent by signing up for a year, but I would’ve had to pay $239.88 upfront. The same goes for the Standard package, although the annual discount is only 13 percent.

Note that these are only the prices for the first year. The annual Standard package renews at $124.99, $35 more than the first year, while the Ultimate Plus annual package costs $339.99, a price increase of over $100. Norton doesn’t list how much the monthly increases are after the first year, although it is clear that the monthly pricing also only applies for the first year.

LifeLock isn’t cheap, but you can save money by signing up for a year. Or, if you’re part of a couple, you can get an Ultimate Plus package for $395.88 a year, that is, $69.99 a month, which is less than the cost of two Ultimate Plus packages. Again, these prices will increase after year one.

LifeLock Features

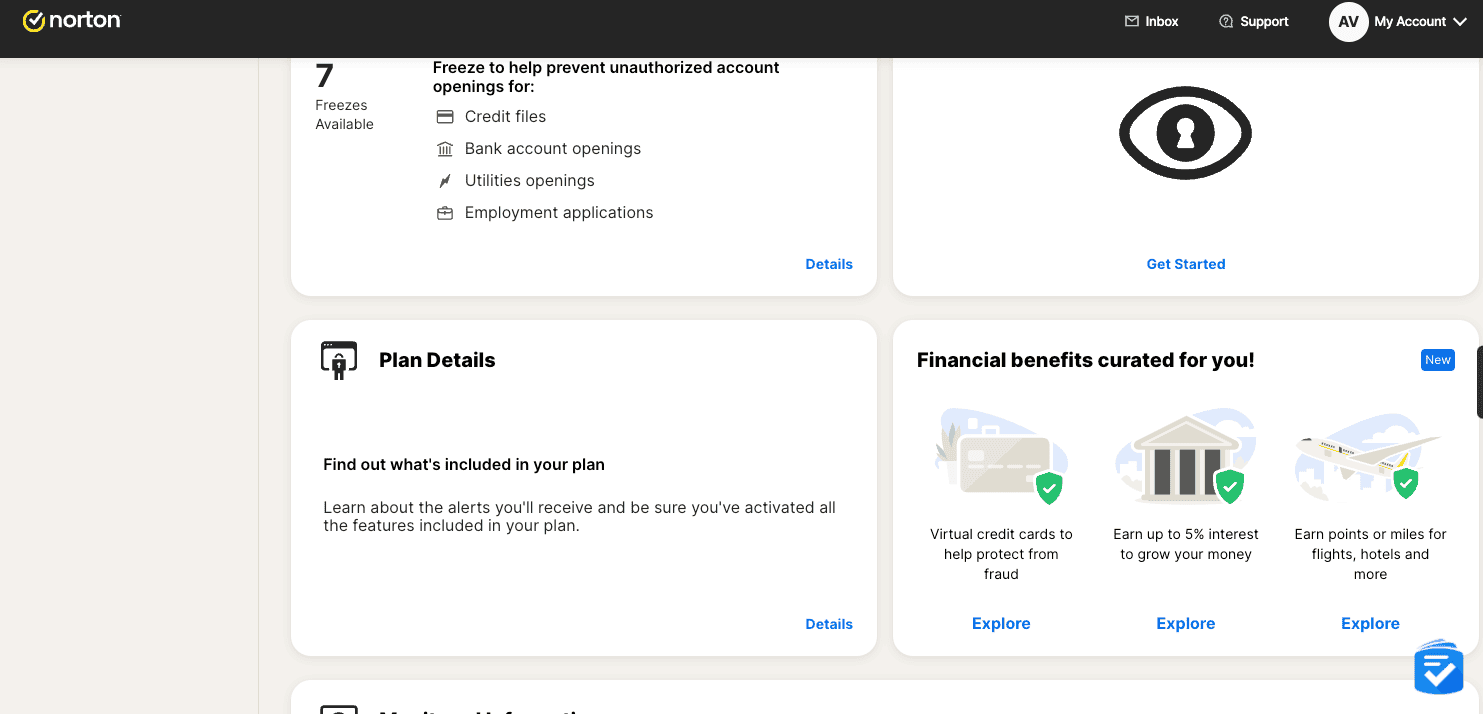

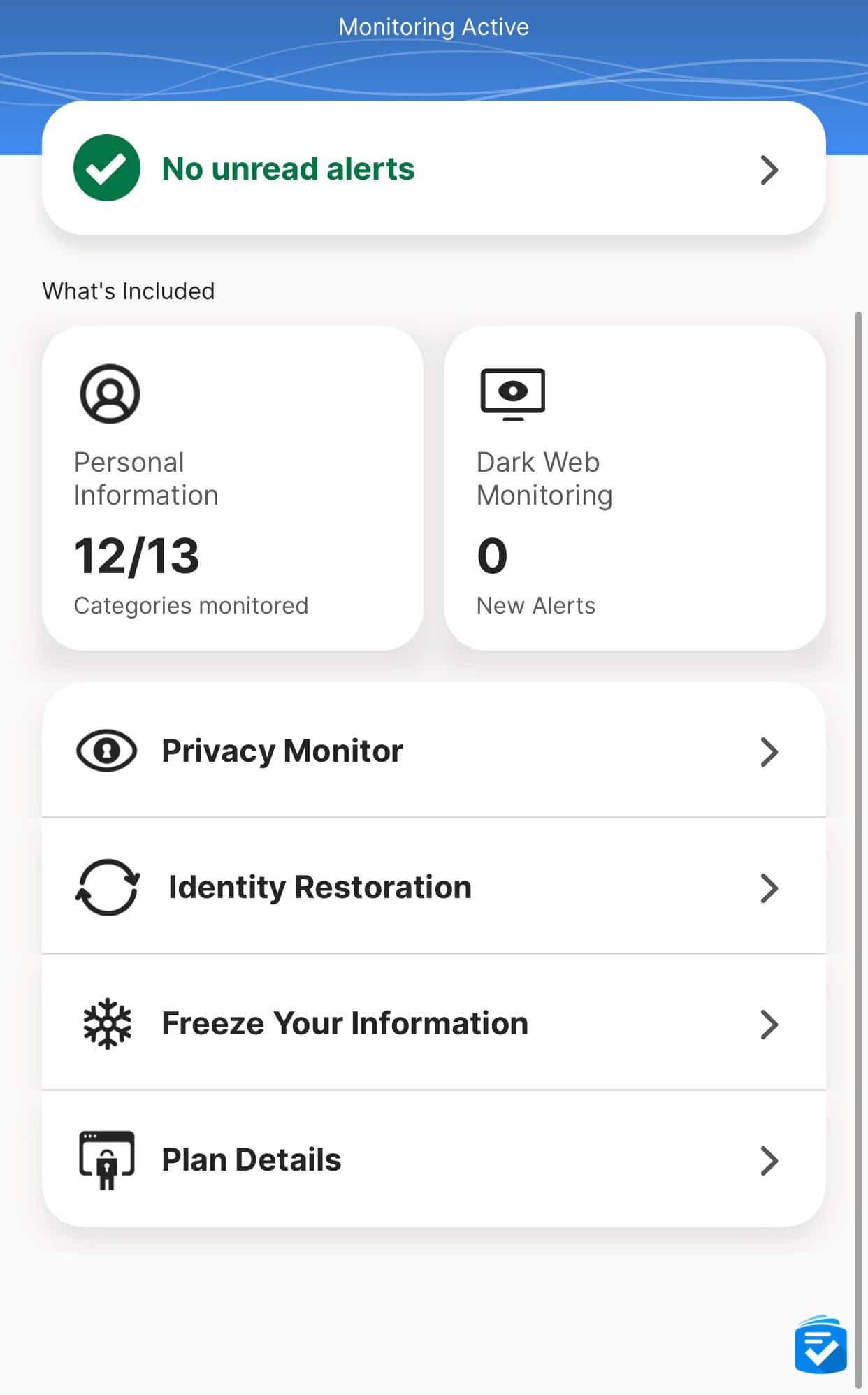

LifeLock provides three main services: identity theft insurance, identity theft monitoring, and identity restoration. The monitoring is the main part of the service, as the insurance and restoration will only kick in if my identity is actually stolen (so far, so good). Let me explain more about exactly what LifeLock provides.

Identity Monitoring

LifeLock scanned multiple areas for my PII, the important information that means someone has stolen my identity. Because I entered in my information when I set up my account, LifeLock had this information and could scan multiple areas for it: the dark web, home titles, and even crime registries, making sure that no one committed a crime and used my name. If the software found my PII where it shouldn’t have been, it would have alerted me immediately so I could freeze my accounts and begin the identity restoration process.

Credit Monitoring

If there are any changes on a credit report, like someone applying for a credit card in my name, it could indicate identity theft. That’s why LifeLock monitors the three major credit-reporting bureaus, Equifax, Transunion, and Experian, to make sure that if there were any changes, I’d be alerted. Note that with the Standard package, however, credit monitoring goes down to only one bureau. Of course, you’re entitled to a free credit report annually, so this isn’t actually a service you need to pay for, but credit monitoring means that you don’t have to worry about checking your reports manually.

Financial Monitoring

Financial monitoring includes monitoring of 401(k) and investment accounts, bank and credit card accounts, and technically, credit reports. If my identity was stolen, say, someone was using my debit card to buy Ubers and DoorDash (which did happen to me once), LifeLock would have spotted it and alerted me immediately. Financial monitoring ties into the reimbursement for lost money, plus any legal fees that I’d need to restore my identity and make myself “whole,” again, financially, at least.

My Experience with LifeLock

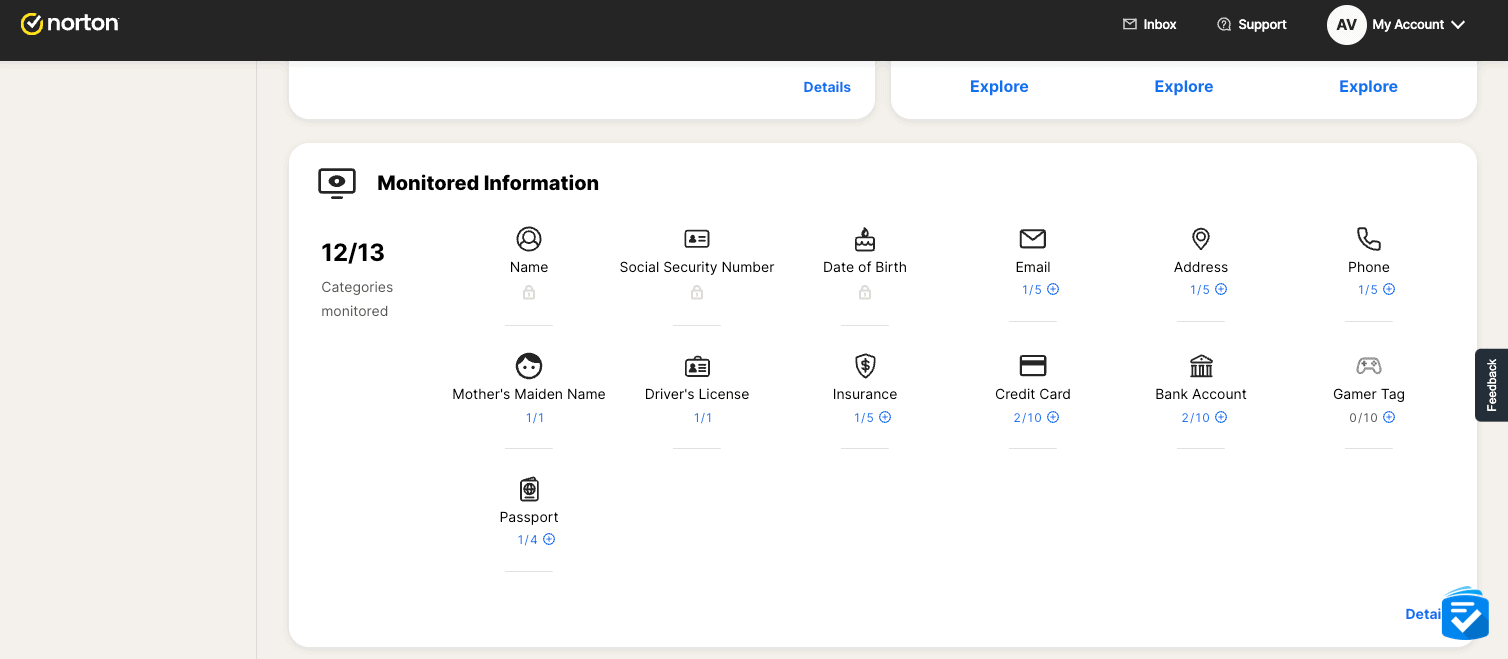

It only took a few minutes for me to get started with LifeLock. First, I purchased the plan I wanted on the Norton website (more on this below). This required me to enter my name, Social Security number, and birth date. Once I was in my account, I added more information so LifeLock could monitor more places for me. That includes information such as:

- Bank account numbers

- Credit card numbers

- Driver’s license number

- Passport number

- Mother’s maiden name

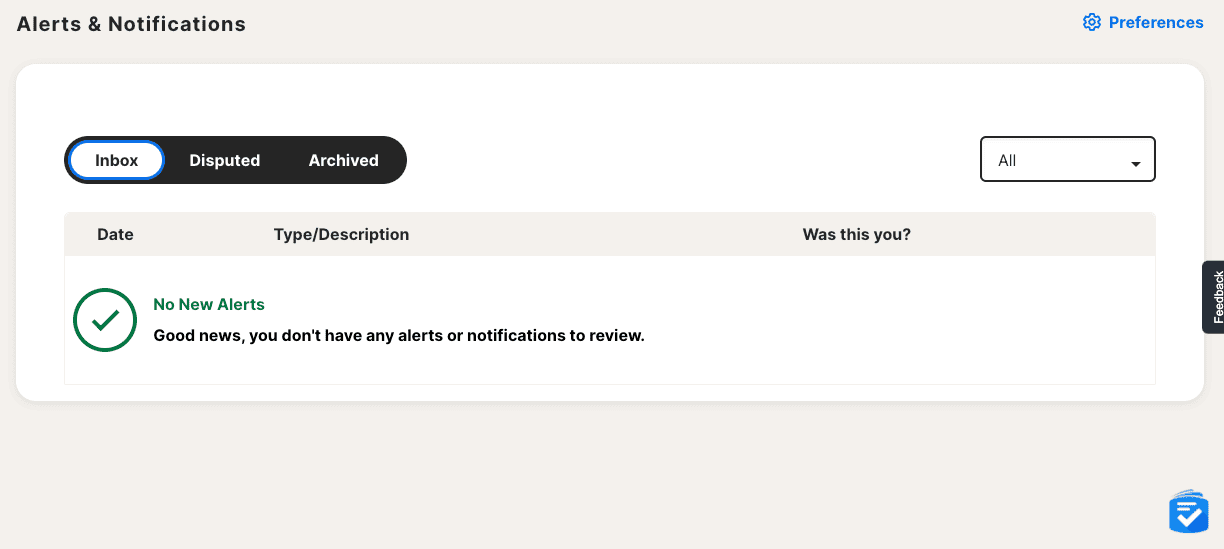

Once I had all of the information filled in, there was nothing else for me to do. LifeLock scans all of these areas for my information, and only notifies me when something is found. This software is of the “set it and forget it” variety. There was nothing I had to do for these scans to happen; rather, I only heard if something went wrong.

I also downloaded the LifeLock app, which could have given me mobile notifications if my PII was found where it shouldn’t be. That being said, I could also sign up for texts or calls, so using the app isn’t a necessity.

Overall, this user experience was very quick and easy, except for one thing. Initially, I signed up for the Standard package, but when I wanted to upgrade to Ultimate Plus, there was no way to do that within my account, despite what multiple support articles said. I ended up having to chat with a robot, then with a person, who told me that to upgrade, my only option was to call. My advice? Make sure you choose the right plan to begin with because, strangely, Norton doesn’t make it easy to upgrade.

LifeLock User Reviews

LifeLock has a 4.6 out of five stars on Trustpilot, a one-star rating from Consumer Affairs, and a 1.09 from customers on the Better Business Bureau (BBB), although the BBB itself gave it an A+. Overall, these ratings aren’t great, and many people weren’t happy with the price increases after the first year, understandably.

That being said, the largest number of reviews, more than 5,000, came from Trustpilot, and 78 percent of reviews gave LifeLock a perfect score. It’s also important to remember most companies have low customer ratings on the BBB, as people only go there to complain. Plus, Norton, the company behind LifeLock, has been accredited with the BBB for more than 20 years, and also has an A+ rating. With hundreds of complaints closed over the years, it’s comforting to know that aggrieved customers do get help from LifeLock.

LifeLock vs. Aura

For an individual, LifeLock is a cheaper option than Aura, with plans starting from $7.50 a month compared to $12 a month. The same is true for couples, as Aura’s pricing starts at $22 a month, while LifeLock’s starts at $19.99 a month. However, given the fact that LifeLock’s prices increase after the first year, Aura may be a better long-term option.

That said, if you want coverage of up to $3 million, LifeLock is for you. Aura’s coverage taps out at $1 million for an individual. Of course, Aura offers some cybersecurity features LifeLock lacks, like antivirus software, a VPN, and a password manager. While Norton offers Norton360, a package including these features, it starts at $49.99 a month compared to $12. If you are looking for a more comprehensive solution, Aura is much cheaper. For identity theft protection on its own, LifeLock is cheaper — for the first year, at least.

I’d recommend LifeLock if you want more coverage and are OK with the price increases after the second year. However, if you want to save money in the long-term or want a more comprehensive cybersecurity solution, Aura is for you.

Frequently Asked Questions

-

How much does LifeLock cost?

LifeLock’s Standard plan for one person costs anywhere from $11.99 a month to $89.99 a year — for the first year. After that, annual packages range from $124.99 to $339.99 a year for individuals.

-

What does LifeLock protect?

LifeLock protects people’s personally identifiable information, or PII. If the software detects someone’s PII has been used or found on the dark web, home titles, social media, 401(k) and investment accounts, or credit reports, LifeLock will alert the person so they can begin restoring their identity and freezing accounts.

-

Does LifeLock have a plan for seniors?

LifeLock does not have a plan for seniors, as of 2025. However, AARP members can get discounts on LifeLock.